In today’s digital age, where information flows freely and first impressions are often made online, building and maintaining credibility is vital for finance companies. The internet is the first place potential clients go to learn about your business. To ensure a positive online presence, implementing effective Online Reputation Management (ORM) strategies is crucial.

Semgeeks helps finance companies build credibility and manage their online reputation through strategic digital marketing solutions. Our team of experts understands the unique challenges faced by finance companies and provides tailored strategies to enhance their online presence, attract new customers, and establish trust with their target audience. With Semgeeks, finance companies can confidently navigate the digital landscape and maintain a positive reputation that sets them apart from their competitors.

Understanding Online Reputation Management (ORM)

Online Reputation Management, or ORM, is the practice of controlling and influencing how your finance company is perceived on the internet. It involves monitoring and managing online reviews, social media mentions, and search engine results to ensure that your business is viewed positively by potential customers.

Why ORM Matters in Finance

- Trust Building: A positive online reputation builds trust with potential clients, making them more likely to choose your finance services over competitors.

- Competitive Advantage: Maintaining a stellar online reputation can give your company a competitive edge in the financial industry.

- Customer Retention: Happy clients are more likely to refer others to your finance company, leading to growth in your customer base.

Effective ORM Strategies for Finance Companies

1. Monitor Your Online Reputation Presence

Use online monitoring tools to keep track of mentions of your finance company on the internet. This allows you to respond promptly to any negative comments or reviews.

2. Encourage Positive Reviews

Request satisfied clients to leave positive reviews on platforms like Google Business Profile and Yelp. Positive reviews can overshadow negative ones.

3. Engage with Your Audience

Active engagement on social media and your website’s blog can humanize your finance company and create a sense of trust.

4. Optimize Your Website

Ensure your website is user-friendly, loads quickly, and contains valuable content relevant to finance topics.

Read More to Dive deeper into these strategies or Connect with Us about how we can help your business.

Understanding Your Target Audience

Understanding your target audience is fundamental for the success of any marketing strategy. For finance companies, this understanding is the key to building credibility and trust, which in turn leads to customer loyalty and increased business.

Define Your Target Market

Begin by defining your target market. This means identifying the demographics, interests, behavior patterns, and needs of your potential customers. With this knowledge, you can tailor your marketing efforts and messages to connect with your audience on a deeper level.

Create Valuable Content

A crucial strategy is to create content that addresses your audience’s pain points and offers solutions. This content can take various forms, such as informative blog posts, videos, podcasts, and more. By providing valuable information, you establish your expertise and credibility in the finance industry.

Harness the Power of SEO

Embrace search engine optimization (SEO) techniques to boost your online visibility and reach your target audience effectively. Optimize your website content with relevant keywords, meta tags, and quality backlinks to improve your search engine rankings and attract organic traffic.

Leverage Social Media

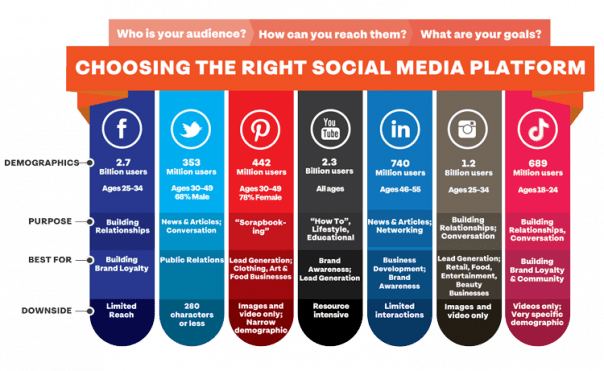

Social media platforms are invaluable for understanding and engaging with your target audience. Actively participate in conversations, share informative content, and interact with your followers. Building relationships and trust on social media is essential for your company’s reputation.

The rise of social media also presents some benefits for businesses. Social media gives companies the opportunity to converse firsthand with customers, according to Shannon Wilkinson, CEO at Reputation Communications, a reputation management agency in New York.

By implementing these strategies, finance companies can gain a deeper understanding of their target audience and create marketing campaigns that resonate. This, in turn, contributes to the development of a strong reputation and credibility within the industry.

Analyzing Your Social Media Platforms and SEO for Finance Companies

Analyzing your social media platforms and implementing effective search engine optimization (SEO) strategies are pivotal for finance companies aiming to build credibility and manage their online reputation.

Social Media Analysis

Social media platforms offer a unique opportunity to connect with your target audience, but they come with distinct guidelines and limitations. To effectively analyze your social media platforms, it’s essential to comprehend what type of content performs best on each platform and tailor your strategies accordingly.

For instance, Facebook is conducive to longer-form content and encourages engagement through comments and shares. On the other hand, Twitter demands concise messaging and effective use of hashtags. By grasping these nuances, you can create content that genuinely resonates with your audience on every platform.

SEO Implementation

SEO is the cornerstone of boosting positive content and mitigating the impact of negative content in search engine results. Effective SEO practices ensure that your positive content takes precedence in search rankings, making it more visible to potential clients.

This involves optimizing your website with relevant keywords, crafting high-quality content, claiming your business directory pages, and establishing quality backlinks to your site. These strategies enhance your online presence and ensure that your finance company is easily discoverable by individuals seeking your services.

By scrutinizing your social media platforms and diligently implementing SEO strategies, finance companies can adeptly manage their online reputation, foster credibility, and engender trust with their target audience in the finance industry.

Assessing Your Online Reputation for Finance Companies

Establishing a robust online reputation is paramount for finance companies, as it directly influences customer trust and purchasing decisions. To adeptly manage your online reputation, it’s crucial to begin with a thorough assessment of your current digital standing.

Monitor and Analyze Your Online Presence

Initiate this process by monitoring and analyzing your online presence across a spectrum of platforms. These include social media channels, review sites and search engine results. To do this effectively, set up Google Alerts to receive timely notifications of any mentions of your company. Also, routinely review customer reviews and feedback. By doing so, you gain valuable insights into the public’s perception of your brand.

Identify Negative Content

By scrutinizing your online presence, you can identify any negative content or comments that warrant attention. Addressing these issues promptly is crucial for rectifying any damage and building a positive image.

Evaluate Existing Online Reputation Management Strategies

Assessing your online reputation also provides an opportunity to evaluate the effectiveness of your existing reputation management strategies. You can determine whether your current approach is consistently maintaining a positive brand image. If adjustments are necessary, this assessment guides you in making the required changes.

In summary, evaluating your online reputation is an essential step for finance companies. It not only helps you understand how your brand is perceived but also allows you to proactively address issues, enhance your online presence, and maintain a positive image in the competitive digital landscape.

Gathering Customer Reviews and Feedback for Finance Companies

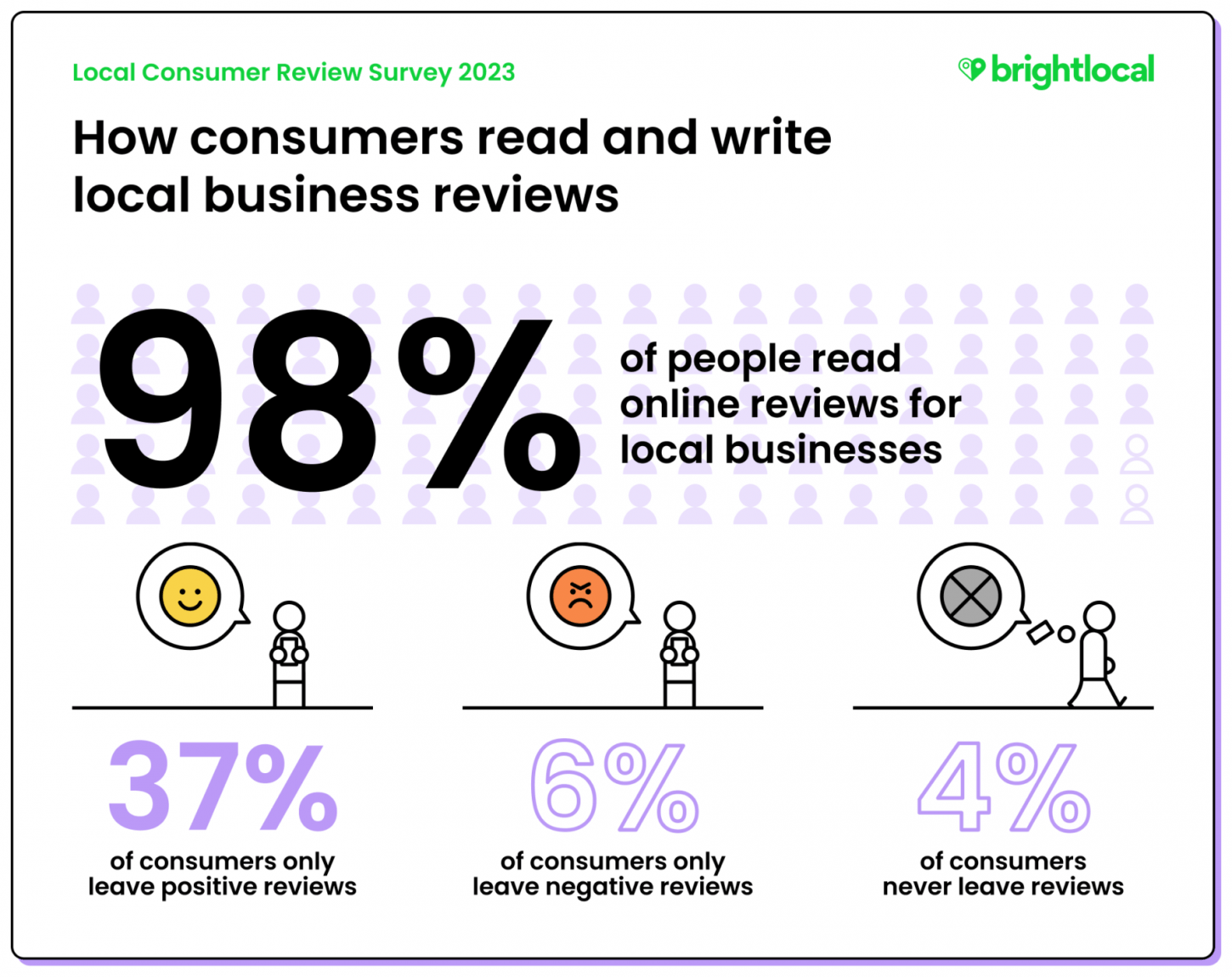

Gathering customer reviews and feedback is a pivotal practice for finance companies looking to build their online reputation and credibility. These insights offer a wealth of information about customer preferences, enabling companies to identify areas for improvement and, in turn, provide a superior customer experience.

Various Methods for Gathering Feedback

Various Methods for Gathering Feedback

Finance companies can employ several effective methods to gather customer feedback. One powerful approach is through customer reviews. By actively encouraging customers to share their experiences on platforms such as social media channels, review sites, or even through their own websites, companies can gain invaluable insights into the customer journey. Surveys are another instrumental tool for capturing feedback. By crafting surveys that cover various facets of the customer experience, companies can collect specific data that helps them understand customer needs and expectations.

Understanding Customer Preferences

Understanding customer preferences is paramount for finance companies as it empowers them to tailor their services accordingly. Analyzing the collected data allows companies to spot emerging trends and adjust their strategies to meet evolving customer demands. This not only enhances customer satisfaction and loyalty but also positions finance companies ahead of their competitors.

The Consequences of Neglecting Customer Experience

Neglecting the customer experience can have detrimental consequences for finance companies. Negative reviews and feedback can tarnish the company’s reputation and dissuade potential customers from engaging with them. Conversely, positive reviews and feedback serve as social proof, fostering trust among consumers and influencing their purchasing decisions.

Analyzing Public Perception of Finance Companies

Analyzing public perception is a critical practice for finance companies to uphold a positive online reputation. There are several methods to monitor and evaluate public sentiment, including leveraging Google Alerts, tracking social media posts, and addressing negative comments.

Harnessing Google Alerts

Google Alerts stands as a potent tool, enabling finance companies to monitor mentions of their brand or company online. By configuring alerts for relevant keywords and phrases, companies can stay abreast of online discussions about their business. This empowers finance companies to gauge online sentiment and promptly identify any negative comments or reviews that might impact their reputation. Moreover, Google Alerts provides an opportunity to proactively address these issues and take appropriate actions to minimize any potential damage.

Monitoring Social Media Posts

Monitoring social media posts represents another vital facet of public perception analysis. Social media platforms offer a direct and immediate channel for customers to voice their opinions and share their experiences. By actively monitoring social media channels and engaging with customers, finance companies can swiftly address concerns or issues in real time. This not only showcases the company’s commitment to customer satisfaction but also contributes to building a positive image and enhancing public perception.

Addressing Negative Comments

Negative comments can wield a significant influence on a company’s reputation. Finance companies must pay heed to negative comments and tackle them promptly. Taking the time to address customer concerns and resolve any issues demonstrates a commitment to providing exceptional customer service. This can potentially transform a negative experience into a positive one and even retain a previously dissatisfied customer.

Crafting Positive Content for Your Website and Social Media Pages

Creating positive content for your website and social media pages is a crucial component of online reputation management for finance companies. By following these steps, you can ensure that your content resonates with your target audience, builds credibility, and enhances your online reputation.

1. Identify Your Target Audience

Begin by understanding your target audience’s demographics, interests, and behaviors. This knowledge will enable you to create content that addresses their specific needs and preferences.

2. Create Valuable and Relevant Content

Once you have a clear understanding of your target audience, focus on crafting content that is valuable and relevant to their interests. Consider sharing customer success stories, highlighting your products and services, and offering motivational quotes or tips that align with your brand. This type of content establishes your expertise and fosters trust with your audience.

3. Optimize Your Content for Each Platform

To maximize the visibility of your content, tailor it to each social media platform and search engine. Familiarize yourself with the guidelines and best practices for each platform, modify your content accordingly, and use appropriate hashtags to increase its reach. This approach enhances your chances of reaching your target audience and generating positive engagement.

Using Strategies to Manage Negative Reviews

Managing negative reviews is a critical aspect of online reputation management for finance companies. Effectively addressing customer feedback and making necessary adjustments to products and services can not only mitigate the impact of negative reviews but also build credibility and strengthen your online reputation.

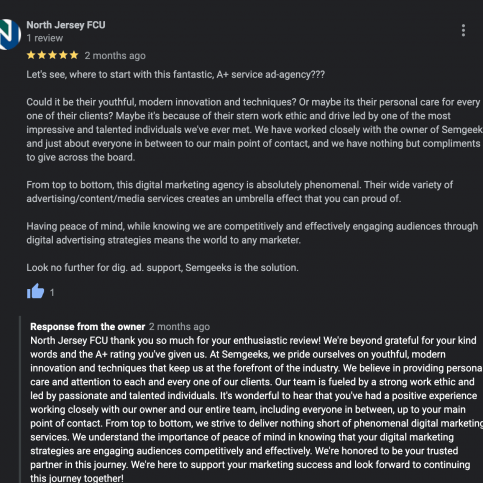

Engaging with Customers and Responding Promptly

One effective strategy for managing negative reviews is to engage with customers and respond promptly to their feedback. Acknowledge their concerns and express empathy for their experience. By demonstrating a genuine interest in resolving any issues, you convey your commitment to customer satisfaction and build trust with potential customers.

Making Necessary Adjustments

Furthermore, it is crucial to consider customer feedback and make necessary adjustments to your products and services. Analyze the underlying reasons for negative reviews and take proactive measures to address any shortcomings. This not only improves your offerings but also demonstrates that you value customer input and are dedicated to providing an excellent customer experience.

Engaging with customer reviews, both positive and negative, is essential for finance companies. Consumers heavily rely on online reviews to make purchasing decisions, and a company’s response to reviews plays a significant role in shaping public perception. By actively engaging with reviews, you can showcase your commitment to customer satisfaction and your dedication to resolving any issues that may arise.

Seeking Professional Assistance in Online Reputation Management

While engaging with customer reviews can be an effective way to manage negative feedback, finance companies may find it beneficial to seek professional assistance in online reputation management. An online reputation management service can provide valuable expertise and resources to help businesses build and maintain a positive online image. These services specialize in monitoring and improving a company’s online presence, utilizing strategies such as search engine optimization and social media management to boost its reputation. By enlisting professional help, finance companies can ensure they have the necessary tools and strategies in place to effectively manage their online reputation and address any negative content. With the assistance of experts in the field, companies can strengthen their credibility and build customer trust in an increasingly digital world.

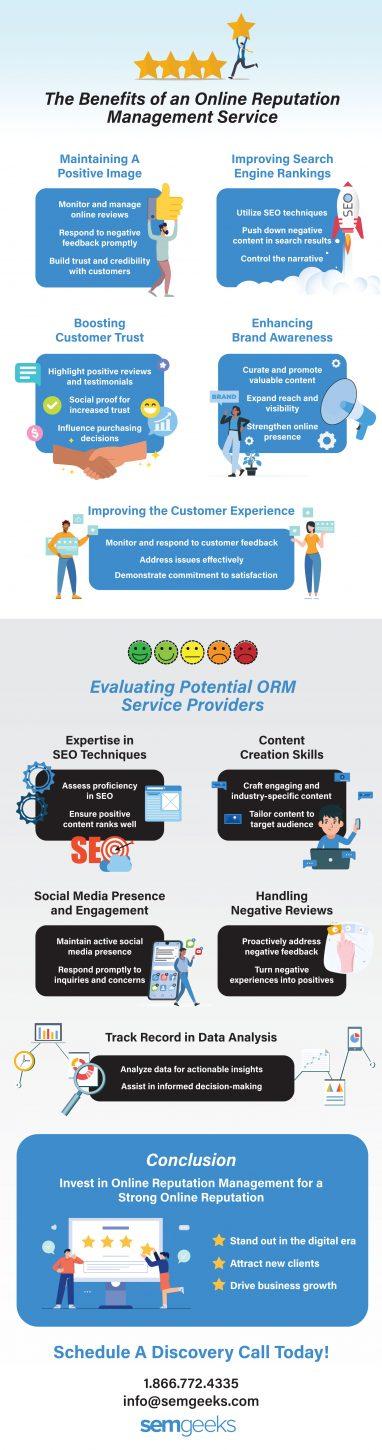

The Benefits of an Online Reputation Management Service

In the digital age, maintaining a positive online image is crucial for finance companies. An Online Reputation Management (ORM) service can provide numerous benefits in relation to building credibility for these companies.

Maintaining a Positive Image

An ORM service helps finance companies maintain a positive image by monitoring and managing online reviews and feedback. They can quickly respond to any negative comments or complaints, ensuring that potential customers see a balanced perspective. This builds trust and credibility with the target audience.

Improving Search Engine Rankings

ORM services focus on improving search engine rankings for finance companies. By utilizing search engine optimization (SEO) techniques and strategies, they ensure that positive content about the company appears at the top of search results, pushing down any negative content. This helps to control the narrative and strengthen the company’s online reputation.

Boosting Customer Trust

Building customer trust is another key benefit of an ORM service. By actively managing the company’s online presence, they can highlight positive reviews and testimonials from satisfied customers. This social proof helps to build trust and confidence in potential customers, who are more likely to make purchasing decisions based on a company’s positive reputation.

Enhancing Brand Awareness

ORM services enhance brand awareness for finance companies by curating and promoting valuable content across various online platforms and social media channels. This expands the company’s reach and visibility, increasing brand awareness and strengthening the company’s overall online presence.

Improving the Customer Experience

ORM services also improve the overall customer experience. By monitoring and responding to customer feedback and concerns, they can effectively address any issues and provide prompt and satisfactory resolutions. This demonstrates the company’s commitment to customer satisfaction and enhances the overall customer experience.

Evaluating Potential Companies to Work With in Online Reputation Management

When finance companies are evaluating potential online reputation management service providers, several key factors should be considered. These factors play a crucial role in determining the effectiveness of the chosen provider in building and maintaining a positive online image. Here are the key considerations:

Expertise in SEO Techniques

A fundamental aspect is assessing the provider’s expertise in SEO techniques. A strong grasp of search engine optimization is essential for ensuring that positive content ranks prominently in search engine results, effectively pushing down any negative content.

Content Creation Skills

The ability to create valuable content is of utmost importance. Providers should demonstrate proficiency in crafting engaging and informative content that highlights the company’s expertise and values. This content should not only be relevant to the target audience but also tailored to the specific nuances of the finance industry.

Social Media Presence and Engagement

Evaluate the provider’s social media presence and engagement capabilities. They should maintain a robust presence on popular social media platforms and exhibit skills in engaging with customers, promptly responding to inquiries, and addressing concerns effectively. An active and responsive social media presence can significantly contribute to a positive online image.

Handling Negative Reviews

The provider’s approach to managing negative reviews is another critical factor. Look for a proactive approach to addressing negative feedback, including strategies such as timely responses, offering solutions, and actively seeking to improve customer satisfaction. The ability to turn negative experiences into positive ones is a valuable skill.

Track Record in Data Analysis

Lastly, evaluate the provider’s track record in generating positive business insights. They should have a proven ability to analyze data, identify trends and patterns, and provide actionable insights that assist finance companies in making informed decisions to enhance their online reputation.

By carefully considering these key factors, finance companies can select an online reputation management service provider that possesses the requisite expertise and strategies to effectively manage their online reputation and cultivate a positive image in the dynamic digital landscape. We would love to have a discovery call with you to help you manage your online reputation.

In the digital era, maintaining a positive online reputation is paramount for finance companies. A strong online presence built on trust and credibility can set you apart from the competition, attract new clients, and drive business growth. Invest in Online Reputation Management to safeguard and enhance your finance company’s reputation in the virtual world.

FAQs

Q1: How long does it take to see improvements in online reputation? A1: It varies but typically takes a few months of consistent ORM efforts to see noticeable improvements.

Q2: Should I respond to negative reviews publicly? A2: Yes, respond professionally and courteously. Show that you care about addressing concerns.

Q3: Can ORM completely eliminate negative content about my finance company? A3: While ORM can suppress negative content, it may not eliminate it entirely.

Various Methods for Gathering Feedback

Various Methods for Gathering Feedback